Invest in Sembly AI

IMPORTANT NOTICE

THIS REG CF OFFERING IS MADE AVAILABLE THROUGH STARTENGINE PRIMARY, LLC. THIS INVESTMENT IS SPECULATIVE, ILLIQUID, AND INVOLVES A HIGH DEGREE OF RISK, INCLUDING THE POSSIBLE LOSS OF YOUR ENTIRE INVESTMENT.

Take Part in the AI Revolution's Next Big Leap

AI is poised to create $4.4 trillion1 in annual economic value, outpacing the industrial revolution. Sembly AI is redefining the boundaries of what is possible to achieve with applied AI at work, while maintaining a sharp focus on privacy and security.

Powerful AI Platform for Working Teams Worldwide

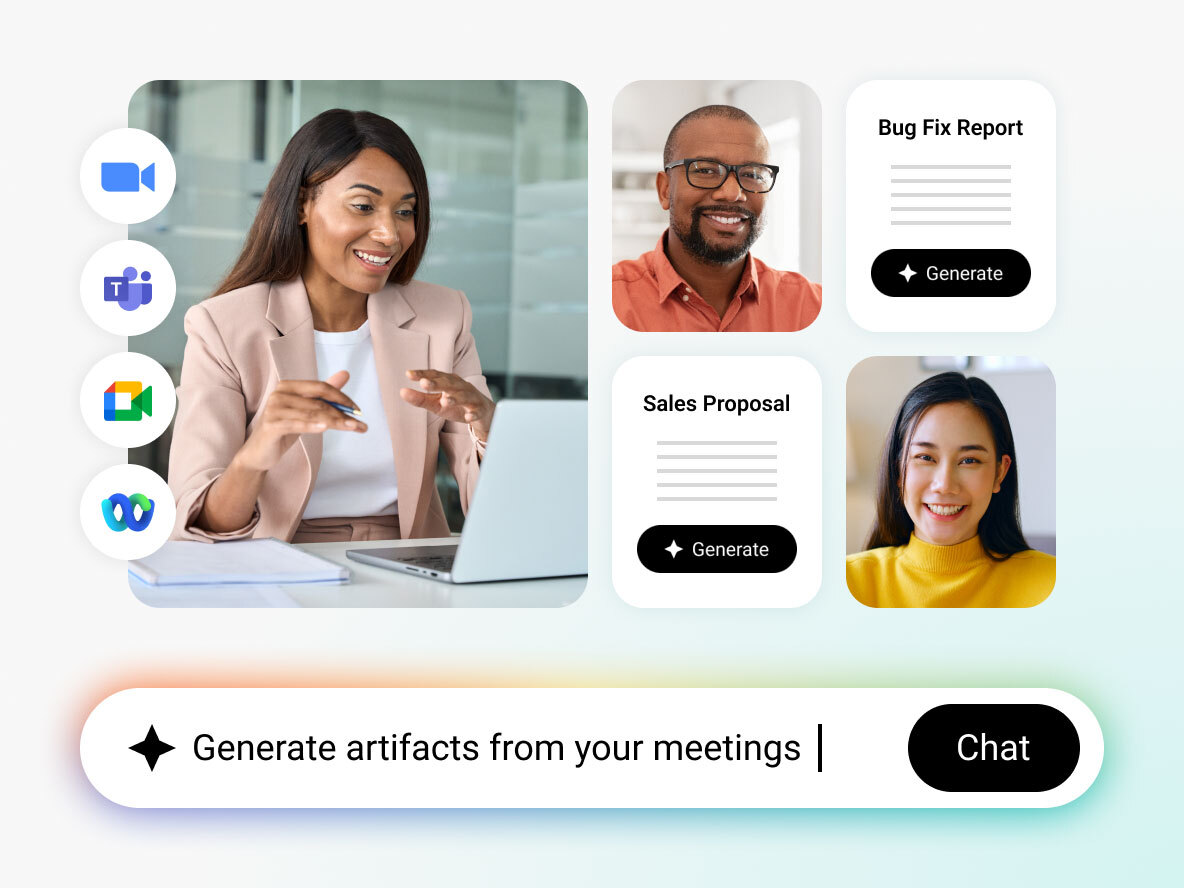

AI Artifacts

Generate complete documents using information from your meetings.

AI Chats

Chat with our AI agent about your entire meeting library.

AI Insights

Personalized tactical recommendations after every meeting.

Automations

Level-up your CRM, task management, and knoweldge base with AI meeting notes and tasks.

Trusted by 1,000+ Leading Companies

1,000,000+

Meetings Processed

1,000+

100+

Countries Served

48+

Languages Supported

Professionals in leading companies accomplish more with Sembly

"Sembly AI is a gem of a tool!"

Timeline of our Milestones

Accelerating Working Team Results

Early 2019

Sembly AI was founded

October 2021

Sembly AI featured on Forbes as a leader in AI-driven meeting technology

February 2022

Sembly AI raises a seed round led by

MIGSO‑PCUBED an ALTEN group company

April 2022

Philips Speech teams up with Sembly AI to launch a co‑branded AI solution for Philips recording devices

June 2022

Sembly AI releases Glance View™, a ground-breaking AI meeting notes experience with meeting chapters

January 2024

Sembly AI reaches $1M in ARR

July 2024

Sembly featured as the “Best AI App for Meetings” by GenAI Works

October 2024

Semblian 2.0 artifact automation and cross-meeting insights captures the top spot on Product Hunt

Early 2025

Notable Publications

Exclusive Investor Perks

Tier 1

Invest at least $250 as Early Bird (first two weeks) and receive the following:

- 10% Bonus Shares

- Free one-month subscription to Sembly Professional and Semblian 2.0

Tier 2

Invest at least $500 as Early Bird (first two weeks) and receive the following:

- 10% Bonus Shares

- Free one-month subscription to Sembly Team and Semblian 2.0 (one user)

Tier 3

Invest at least $1,000 as Early Bird (first two weeks) and receive the following:

- 10% Bonus Shares

- Free one-month subscription to Sembly Team and Semblian 2.0 (two users)

Tier 4

Invest at least $5,000 as Early Bird (first two weeks) and receive the following:

- 15% Bonus Shares

- Free one year subscription to Sembly Team and Semblian 2.0 (two users)

+ Sembly AI T-Shirt

Tier 5

Invest at least $10,000 as Early Bird (first two weeks) and receive the following:

- 20% Bonus Shares

- Free one-year subscription to Sembly Team and Semblian 2.0 (five users)

After the first two weeks:

- 10% Bonus Shares

+ Sembly AI Hoodie

Tier 6

Invest at least $25,000 as Early Bird (first two weeks) and receive the following:

- 25% Bonus Shares

- Free one-year subscription to Sembly Team and Semblian 2.0 (five users)

After the first two weeks:

- 15% Bonus Shares

+ Sembly AI T-Shirt, Hoodie, Collector Item

Tier 7

Invest at least $50,000 as Early Bird (first two weeks) and receive the following:

- 30% Bonus Shares

- Free one-year subscription to Sembly Team and Semblian 2.0 (five users)

After the first two weeks:

- 20% Bonus Shares

+ Online meeting with a co-founder & Collector Item

Expert Leadership and Visionary Founders

Gil Makleff

- • Former CEO of UMT Consulting Group (now EY)

- • Americas Region Partner, EY Advisory

- • Previous Exits: 2006 sale to Microsoft

- • Previous Exits: 2015 sale to EY

- • Columbia University CS, NYU MBA

Artem Koren

- • Co-founder Neusana

- • CTO of Visual Trading Systems

- • Director of IT Capital Market Services

- • Senior Manager (top 1%) at EY

- • Columbia University CS, NYU MBA

Sembly AI Team

- • 25+ team members

- • Presence in 8+ countries across Europe and the United States

- • PhDs, MBAs, and MAs across various disciplines

- • Senior specialists across cloud, ASR, NLP, ML, responsive UI, and data pipelines

Get Equity

Crowdfunding FAQ

Investing in startups offers the opportunity to support innovative ideas and emerging companies at the forefront of industry change. By investing, you can take part in the exciting AI revolution, contributing to the development of groundbreaking technologies that have the potential to transform industries and everyday life. Startups have the potential for high growth, which can lead to substantial returns for investors if the business succeeds.

It’s important to note, however, that investing in startups carries risks, including the potential loss of your investment, as startups are inherently speculative and not guaranteed to succeed.

Under Regulation Crowdfunding, the amount you can invest depends on your annual income and net worth:

- If either your annual income or net worth is less than $124,000, you can invest up to 5% of the greater of the two amounts.

- If both your annual income and net worth are $124,000 or more, you can invest up to 10% of the greater of the two amounts.

These limits apply to the total amount you can invest across all Regulation Crowdfunding offerings in a 12-month period.

Anyone over 18 years of age can invest in Regulation Crowdfunding offerings, regardless of income or net worth. However, there are limits on how much you can invest based on your annual income and net worth, as defined by Regulation Crowdfunding rules:

- If your annual income or net worth is less than $124,000, you can invest up to 5% of the greater of the two amounts.

- If both your annual income and net worth are $124,000 or more, you can invest up to 10% of the greater of the two amounts.

These rules apply to all Regulation Crowdfunding investments made in a 12-month period. Investors should also review the risks and ensure they understand the terms of the offering before making a commitment.

Investing in early-stage companies can be exciting and potentially rewarding, as you have the chance to support innovative businesses and technologies in their formative years. If the company succeeds, your investment could grow significantly in value. However, it’s important to understand the risks and characteristics of early-stage investing:

- High Risk, High Reward: Startups are inherently risky. If the company fails, you could lose your entire investment.

- Long Time Horizons: Returns, if any, often take five to seven years (or longer) to materialize, typically through an acquisition, IPO, or another liquidity event.

- Dilution: Over time, your ownership percentage may decrease if the company raises additional funding.

- Limited Control: As an investor, you may have little to no say in the company’s management or operations.

- Uncertainty: Early-stage companies are still refining their products, services, and business models, so success is not guaranteed.

If a company has reached their maximum funding goal, you can submit an “indication of interest.” An indication of interest is similar to a reservation. It is a non-binding commitment that allows you to be placed on a waitlist for any offerings that are oversubscribed, meaning they have raised more than their maximum funding goal. This is not an investment and does not guarantee a place in the offering

The Most Recent Sembly Insights

- Item Top 8 AI Email Assistants for 2025 That Will Transform Your Inbox

- 7 Top AI Market Research Tools To Consider in 2025

- 9 Leading HR AI Tools: Your Comprehensive Guide for 2025

- How to Create a Sales Plan: Templates and Examples

- Why Do You Need AI Reporting Tools in 2025

- Sales Process Optimization: Understanding the Sales Process

- What is a Debrief Meeting and How to Host One? {Questions & Templates}

- Questions About Using AI, Answered

- AI in HR: Leverage AI for Business Success

- The 9 Best Proposal Software Tools

- Where do Zoom Recordings Go How to Find Them

- Investing in an AI Startup: Everything You Need to Know

- Sembly AI was featured in Top Productivity Software for Businesses 2025 by Tekpon

- Product Management Tools: Building a Comprehensive Product Stack

- How Generative AI for Sales is Transforming the Industry

- How to Write a Consulting Proposal (Templates & Examples) for 2025

- Top AI in Marketing Examples and Real-World Success Stories

- AI in Content Marketing: Smarter Creation, Faster Growth

- How to Create a Marketing Automation Strategy – 6 Simple Steps

- Mastering AI Marketing Automation to Drive Better Results

- Top 9 Otter.AI Alternatives & Competitors in 2025

- CRM vs Marketing Automation: Which Suits Your Business?

- What is Personal Selling and Its Role in Business Growth

- Benefits of Marketing Automation: 9 Key Gains for Your Business

- Mastering B2B Marketing Automation: The Best Practices for Success

- The Complete Manual for Digital Product Management

- Six Essential Tips for Refining Your Product Management Workflow

- 12 Best Sales Automation Tools for Closing Deals in 2025

- Harnessing AI in B2B Sales: Innovative Ways to Boost Revenue

- How to Improve Sales Performance and Drive Results [Data-Backed Tips]

Other articles you might like

- How to Set Team Goals: Examples for Success for 2025

- 15 Customer Service Performance Review Phrases in 2025

- 15 Best Sales Enablement Tools for Sales Teams in 2025

- How to Record a Webex Meeting Step-by-Step

- The Best Note-Taking Methods and Types: How To Take Notes in 2025?

- 26 Best Ways To Make Passive Income in 2025: Smart and Easy Options

- Top 10 AI Text Generators in 2025

- 8 Meeting Minutes Templates, Examples, and Automations for 2025

- Top 11 Data Automation Tools and Solutions for 2025

- Using AI in Project Management: Key Tools and Benefits

- Workstreams in Project Management: Definition, Benefits and Examples

- Jira Automation Examples, Rules, Ideas: All You Need to Know

- What are AI Artifacts and How to Use Them Effectively?

- 16 Best ChatGPT Alternatives: Get Insights and Answers

- Getting Started with AI Teammates: Features and Functions

- Unlocking AI Product Management: The Ultimate Guide

- Top 12 AI Sales Tools for 2025 That Will Skyrocket Your Productivity

- AI Sales Assistants: Shaping the Future of Sales in 2025

- The Critical Stages of the Product Management Life Cycle Explained

- How to Improve Sales Performance and Drive Results [Data-Backed Tips]

- The Core Product Manager Skills in 2025

- The Ultimate Guide to Product Manager vs Project Manager

- How Document Automation for Sales Can Boost Your Efficiency

- Harnessing AI in B2B Sales: Innovative Ways to Boost Revenue

- 12 Best Sales Automation Tools for Closing Deals in 2025

- Six Essential Tips for Refining Your Product Management Workflow

- The Complete Manual for Digital Product Management

- Mastering B2B Marketing Automation: The Best Practices for Success

- Benefits of Marketing Automation: 9 Key Gains for Your Business

- What is Personal Selling and Its Role in Business Growth